Reconciliation

| The Reconciliation module works with selected acquirers . Please contact us to see if your acquirer supports reconciliation. |

Data files

A data file is a file comparable to a bank statement, issued by an acquirer. It's also referred to as an EPA file. Only selected acquirers send data files to our system (please check with our Customer Care department if they apply to you).

Using data files from the acquirers, our system can pre-process the data, making the reconciliation task easier for you.

Important

|

1. Reconciliation menu

Once Reconciliation is activated in your Viveum account, you can find the button in the top menu of your account.

The Reconciliation menu item contains the following sub-items:

- Reporting allows you to view your reconciled transactions;

- Configuration allows you to specify your bank account numbers for the Reconciliation Module and configure Push Reports.

- Download allows you to download different types of reports directly from your Viveum Account.

- Dispute allows you to see retrieval requests and chargebacks issued for your card transactions (Viveum Collect only)

1.1 Reporting

The reporting screen is divided into 3 tabs. These tabs reflect the full lifecycle of a transaction. A transaction will therefore only appear in one tab at a time, depending on the status.

|

|

Processed transactions: this view compiles all transactions which have been processed on the gateway, but for which the money has not yet been received by Viveum Financial Solutions, and therefore has not yet been paid out. Your Balance (only for Viveum Collect merchants) : this view compiles all transactions which have been processed on the gateway, and for which the money has been received by Viveum Financial Solutions but has not yet been paid out. Payout view: this view compiles all details of transactions which have been paid out by your acquirer or Viveum Financial Solutions. |

1.1.1 Processed transactions

The "Processed transactions overview" indicates the total number of pending transactions, for which the money has not yet been paid by the acquirer or received by Viveum, grouped by currency.

The following columns are displayed:

| Name | Description | Example |

|---|---|---|

| Currency | Transaction currency | EUR |

| Total paid amount | Transaction amount | 1 EUR |

| Number of transactions | For grouped transactions, the number of transactions contained in the current line. | 1 |

| Action | Clicking the "Details" button will take you to the list of included transactions where you can access each transaction's financial history individually. | - |

Example:

In the "Processed transactions summary based on currency", by selecting a currency in the dropdown menu, you can see details of the pending transactions per brand.

The following columns are displayed:

| Name | Description | Example |

|---|---|---|

| Brand | Payment method of the transaction | Visa |

| Total paid amount | Amount of the transaction | 1 EUR |

| Number of transactions | For grouped transactions, the number of transactions contained in the current line. | 1 |

| Action | Clicking the "Details" button will take you to the list of included transactions where you can access each transaction's financial history individually. | - |

Example:

By clicking the blue arrow on the left, you can see the details per item type: Payments, Refunds and Deleted payments:

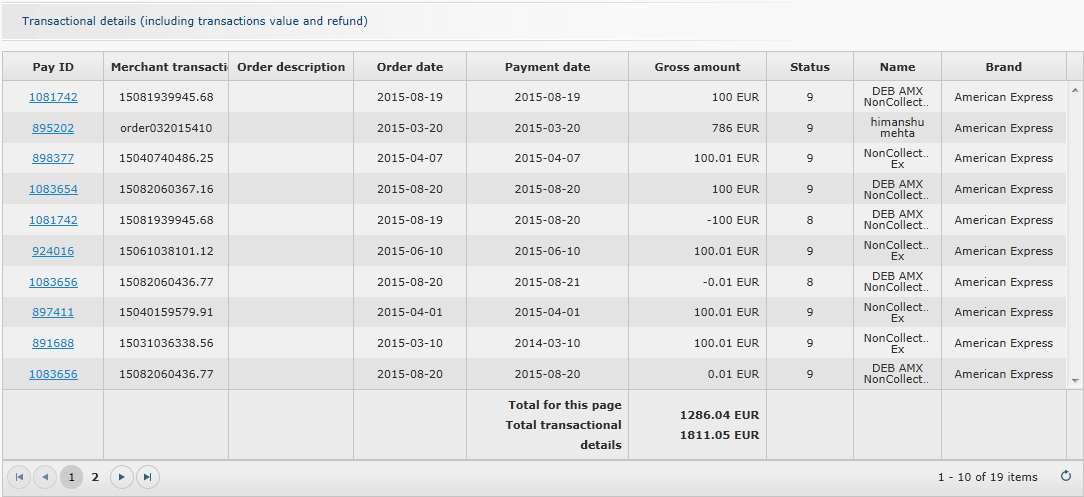

Clicking the details button will take you to the list of included transactions where you can access each transaction's financial history individually.

The following columns are displayed:

| Name | Description | Example |

|---|---|---|

| Pay ID | Payment unique identifier | 100633195 |

| Merchant transaction ref. | Merchant Order ID | order123ab |

| Order description | Merchant order description | abc |

| Order date | Order date (yyyy-MM-dd) | 2014-08-07 |

| Payment date | Transaction date (yyyy-MM-dd) | 2014-08-07 |

| Gross amount | The total amount of the transaction or group of transactions (including acquirer fees). This is the amount you see in the back office, e.g. in the Financial history. |

13.52 EUR |

| Status | Gateway status of the transaction (e.g. 9 - Payment requested) | 9 |

| Name | Name of the buyer | John Doe |

| Brand | Payment method of the transaction | iDEAL |

Example:

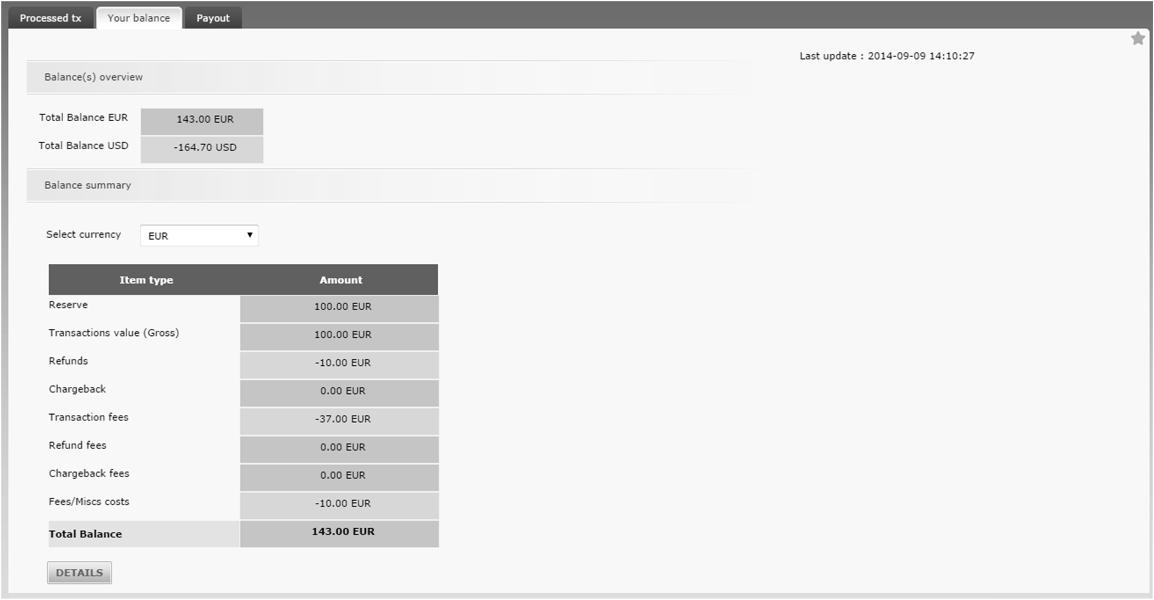

1.1.2 Your balance

This view allows you to check your current account balance at Viveum Financial Solutions. A timestamp indicates the last update of the balance.

The first section shows the balance overview (total) per settlement currency.

The second section shows the Balance summary of the selected settlement currency, per operation type (Transaction, refunds, chargebacks, fees and miscellaneous costs). You can change currency using the dropdown menu if your account supports multiple settlement currencies.

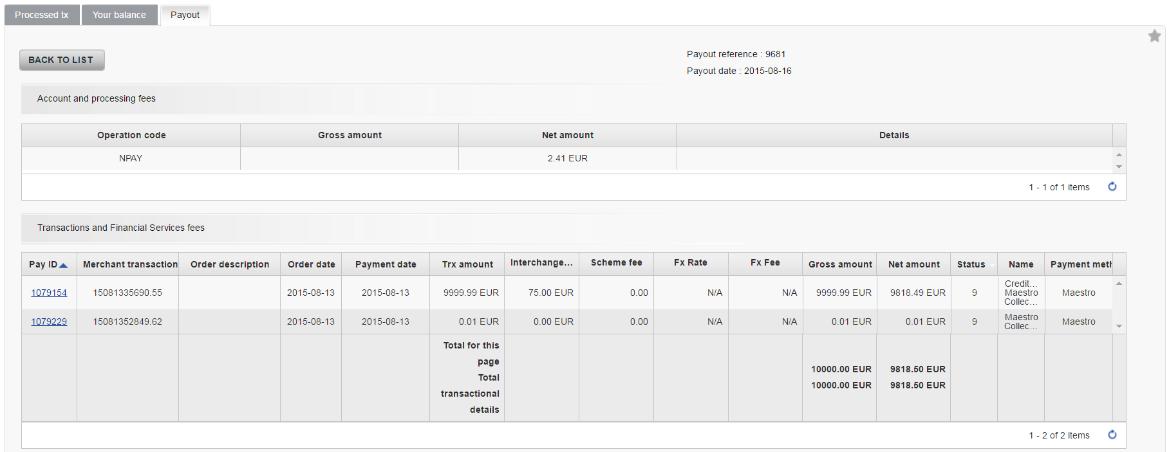

By clicking on the button “Details”, you can check all "Account and processing fees" and "Transaction and financial service fees" details which have occurred on your balance.

Your current “balance amount” is equal to the “Transaction and financial service fees” minus the “Account and processing fees”.

Here is the description of the view:

| Name | Content | Example |

|---|---|---|

| Account and processing fees | ||

| Operation code | Operation type (See non-transactional “Operation types” in push report guide for all possible values) | NAST |

| Details | The description of the operation | Account setup |

| Transaction and financial service fees | ||

| Pay ID | Payment unique identifier | 100633195 |

| Merchant transaction ref | Merchant Order ID | order123ab |

| Order description | Merchant Order description | abc |

| Order date | Date of the order | 2014-08-07 |

| Payment date | Transaction date (yyyy-MM-dd) | 2014-08-07 |

| Transaction amount |

The total amount of the transaction or group of transactions (including acquirer fees). This is the amount you see in the back office, e.g. in the Financial history. |

14,31 EUR |

| Interchange amount (available from 01/2015) | Fee paid between banks for the acceptance of card based transactions (expressed in the smallest unit of the currency used). | |

| Scheme Fee | Scheme fee | 0,10 EUR |

| Fx Rate | Exchange rate | 0,12 |

| Fx Fee | Exchange fee | 0,10 EUR |

| Gross amount | Transaction amount expressed in the merchant’s currency | 13,52 EUR |

| Net amount | The amount you receive on your bank account (=gross amount minus the acquirer commission, chargebacks and other costs) | 13,52 EUR |

| Status | Gateway status of the transaction (i.e. 9 - Payment requested) | 9 |

| Name | Name of the buyer | John Doe |

| Payment method | Payment method of the transaction | iDEAL |

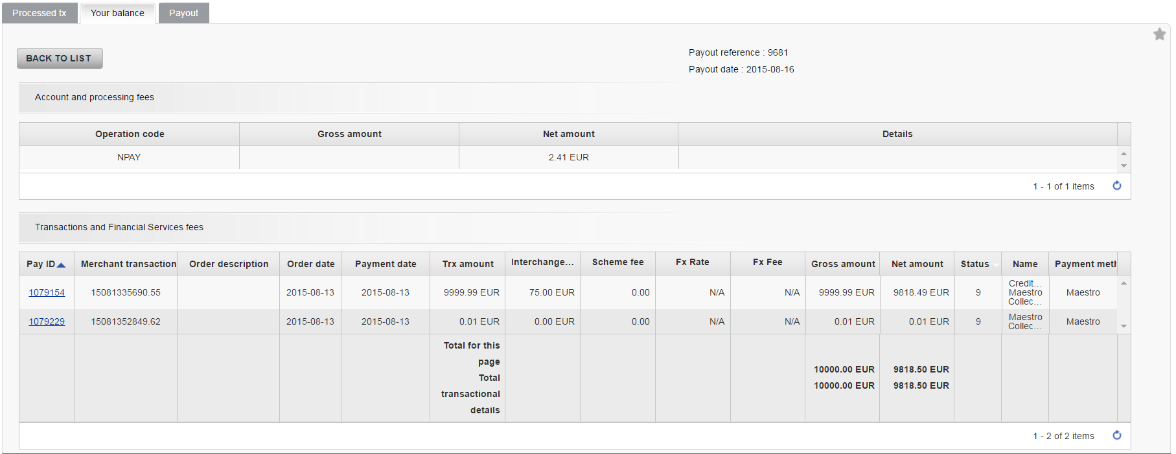

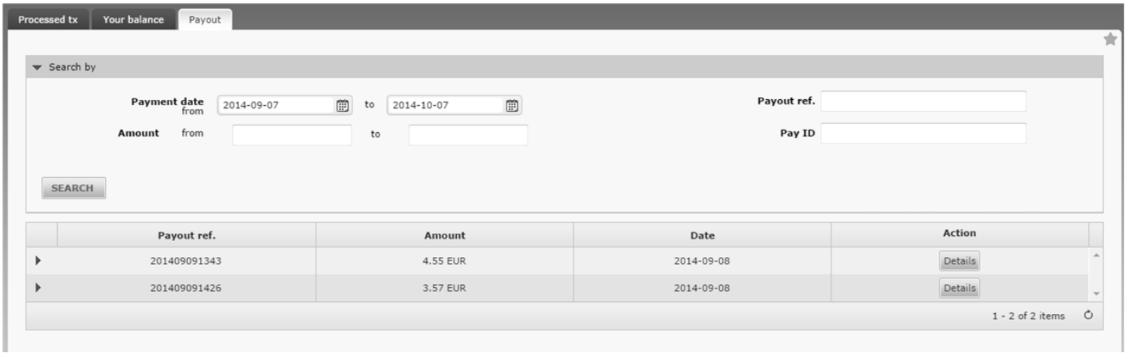

1.1.3 Payout

This view allows you to see the payouts which have been done by your acquirer/collector.

A search section allows you to limit the list based on payout date, payout amount or payout reference.

The table shows the list of payouts with amounts, sorted by date (last one first). The payout reference is the number mentioned in the structured communication of the payment visible on your bank statement.

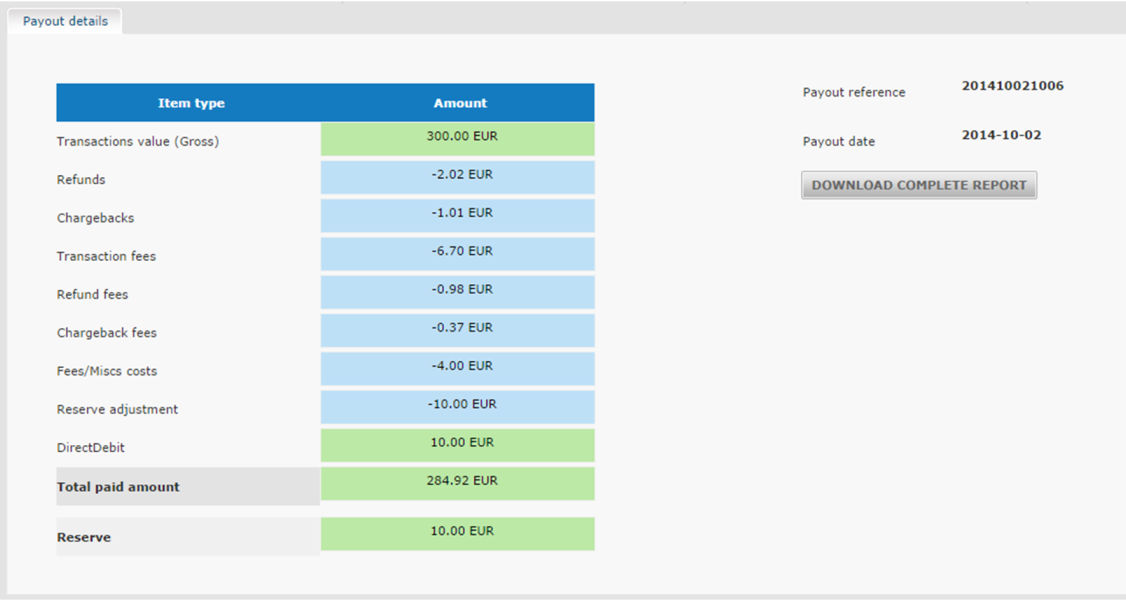

By clicking on the green arrow on the left, you can see the payout details and all associated operation type (Transaction, refunds, chargebacks, fees and miscellaneous costs, reserve adjustments or direct debits). You can download details by clicking on the button “Download complete report”. The file structure is described in the Push Reports guide.

By clicking on the button “Details”, you can check all "Account and processing fees" and "Transaction and financial services" details which are associated to the selected payout.

Your current “Payout amount” is equal to the “Transaction and financial services” minus the “Account and processing fees” minus the “Payout operations”.

Here is the description of the view:

| Name | Content | Example |

|---|---|---|

| Account and processing fees | ||

| Operation code | Operation type (See non-transactional “Operation types” in push report guide for all possible values) | NAST |

| Details |

The description of the operation | Account setup |

| Transaction and financial services | ||

| Pay ID | Payment unique identifier | 100633195 |

| Merchant transaction ref | Merchant Order ID | order123ab |

| Order description | Merchant Order description | abc |

| Order date | Date of the order | 2014-08-07 |

| Payment date | Transaction date (yyyy-MM-dd) | 2014-08-07 |

| Transaction amount |

The total amount of the transaction or group of transactions (including acquirer fees). |

14.31 EURO |

| Interchange amount (available from 01/2015) | Fee paid between banks for the acceptance of card based transactions (expressed in the smallest unit of the currency used). | 0,10 EUR |

| Scheme Fee |

Scheme fee |

0,10 EUR |

| Fx Rate |

Exchange rate |

0,12 |

| Fx Fee |

Exchange fee |

0,10 EUR |

| Gross amount | Transaction amount expressed in the merchant’s currency |

13,52 EUR |

| Net amount |

The amount you receive on your bank account (=gross amount minus the acquirer commission, chargebacks and other costs) |

0,10 EUR |

| Status | Gateway status of the transaction (i.e. 9 - Payment requested) | 9 |

| Name | Name of the buyer | John Doe |

| Payment method | Payment method of the transaction | iDEAL |

| Payout operations (ie. reserve adjustments and direct debits). (available from 01/2015) | ||

| Operation code | Operation type (See non-transactional “Operation types” in push report guide for all possible values) | NDDP |

| Gross amount | Empty for non-transactional details | |

| Net amount | The amount of the operation + currency | 10 EUR |

| Details | The description of the operation | Direct debit |

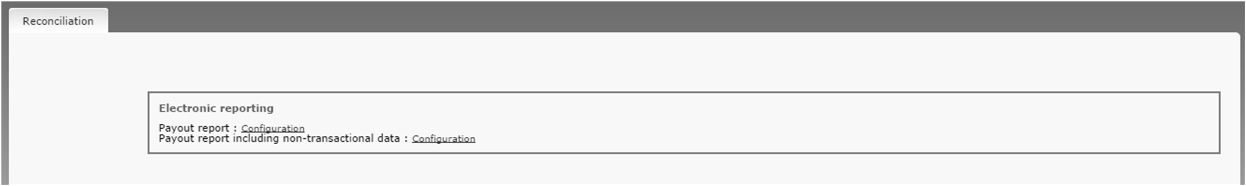

1.2 Configuration

At the top of the configuration screen, you will see the "Electronic Reporting" section of your account. The section will propose pre-configured reports. Payout Reports are sent every time the acquirer or collector confirms the payment of the money on your bank account.

You can activate:

- The “Payout report” which includes only transactional data (Transactions, refunds, chargebacks, chargebacks reversal).

- The “Payout Report including non-transactional data” which includes both transactional (as mentioned above) and non-transactional data if applicable (ie. Account/service setup fees, monthly/yearly fees, payout fees, additional refunds/chargebacks/authorization fees, reserve adjustments and direct debits).

If you have configured push reports before October 2014, you may still have old versions of reports configured, as follows:

- Payout Confirmations sends a daily report with transactions for which the payment has been confirmed by the acquirer.

- Reconciled Payments sends a report of the day's reconciled payments (payments for which you've performed the reconciliation). This functionality and report has been discontinued as of October 2014.

- Payout Reference (Viveum Collect) sends a report with the reference number mentioned in the structured communication of a payment on your bank statement.

Note: You need to have the Push Reports option activated in your account for this feature to be operational. 3 reconciliation push reports are included by default for Viveum Collect merchants.

You can see the file structure in the Push Reports guide.

1.3 Download

In the Reconciliation Download screen, you can download two types of reconciliation reports:

- The “Payout report” which includes only transactional data (Transactions, refunds, chargebacks, chargebacks reversal)

- The “Payout Report including non-transactional data” which includes both transactional (as mentioned above) and non-transactional data if applicable (ie. Account/service setup fees, monthly/yearly fees, payout fees, additional refunds/chargebacks/authorization fees).

You can download based on payout date (the date on which the acquirer/collector confirmed the payment of the money on your bank account) or payout reference (the number mentioned in the structured communication of a payment on your bank statement

Furthermore, you can choose the file format you want to download your report in: "csv" or "txt".

The file structure is described in the Push Reports guide.

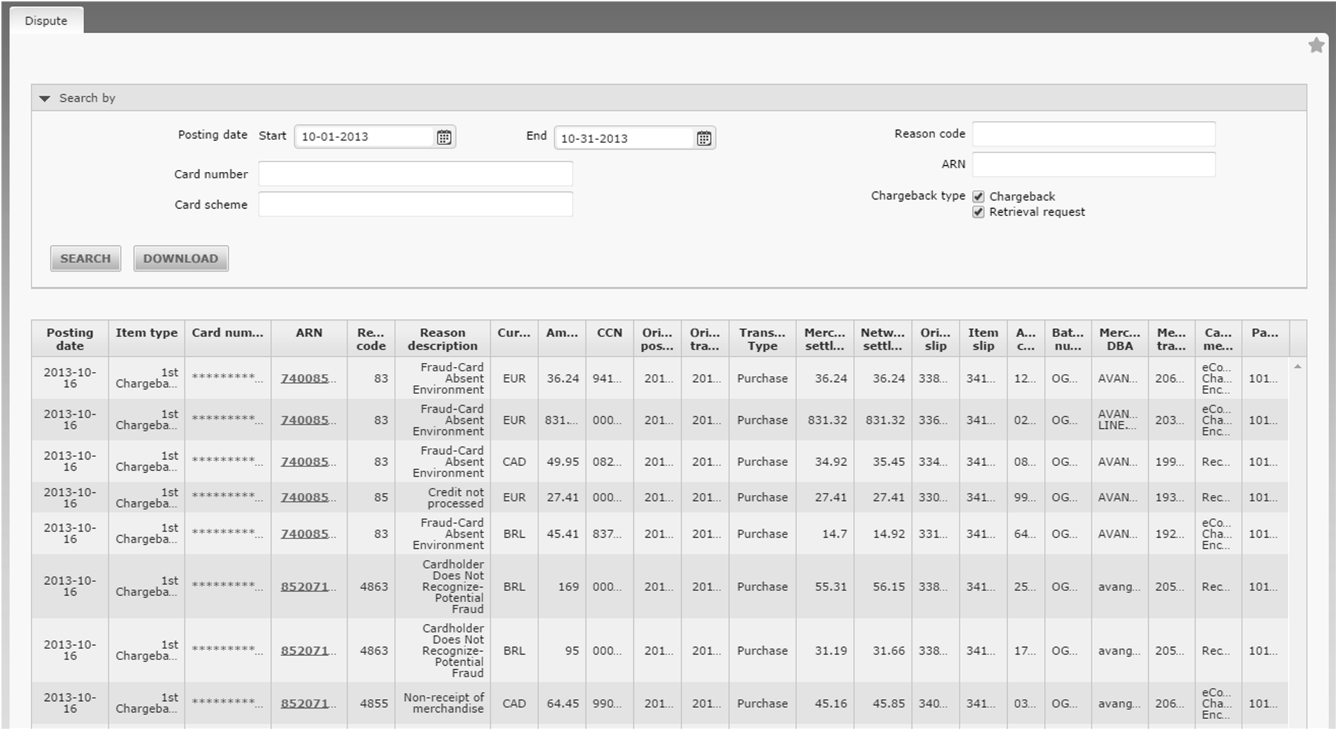

1.4 Dispute

The dispute module shows the transactions involved in the dispute life cycle, including retrieval requests, first and second chargebacks, representments.

The transactions are grouped together by the Acquirer Reference Number (ARN), which acts as a unique identifier for the chargeback life cycle. It is possible to search for retrieval requests or chargebacks using the posting date, some reference of the card number, card scheme, reason code or acquirer reference number.

|

Name | Content | Example |

|---|---|---|

| Posting date | The processing date of the dispute | 2014-10-16 |

| Item type |

Possible values are:

|

1st chargeback |

| Card number | Card number | ************0143 |

| ARN | The Acquirer reference number (ARN) is the same for all transactions in the dispute life cycle. | 74008503273338307683984 |

| Reason code |

The card scheme dispute reason code (Not filled for all item types.) Please find a list of possible reason codes here (docx file download). |

83 |

| Reason description | The card scheme dispute free-text description of the reason code. (Not filled for all item types.) | Fraud-Card Absent Environment |

| Currency | The currency of the acquirer dispute account to which the transaction is posted. | EUR |

| Amount | The amount of the transaction, expressed in the account currency. | 36.24 |

| CCN | The issuer reference number (Chargeback Control Number/CCN) for the transaction. (Not filled for all item types.) | 941679 |

| Original posting date | The posting date of the original presentment. | 20130930 |

| Original transaction date | The transaction date of the original presentment. | 20130930 |

| Transaction type | Transaction type of the original presentment. | Purchase |

| Merchant settled amount | The amount settled with the merchant for the original presentment in the merchant funding currency (that is, the amount posted to the merchant account), before the deduction of any charges. | 36.24 |

| Network settled amount | Currency and amount settled with the payment network for the presentment (that is, the interchange settlement amount), before the deduction of any charges. | 36.24 |

| Original slip | The internal slip number of the original presentment. | 33830768659 |

| Item slip | The internal slip number of the transaction (that is, of the 1st chargeback, representment, and so on). | 34135120814 |

| Auth code | The authorisation code of the original presentment. | 127309 |

| Batch number | The batch number provided by the submitter of the original presentment. | OGV131001_01 |

| Merchant DBA | The “Doing Business As” name of the merchant. | Viveum |

| Merchant transaction ref | The merchant’s transaction reference number. | 20604728 |

| Capture mode | Transaction data capture method | eCommerce |

| Payid | Viveum payment unique identifier | 100633195 |

When a search has been performed, you can also download the displayed information in csv.

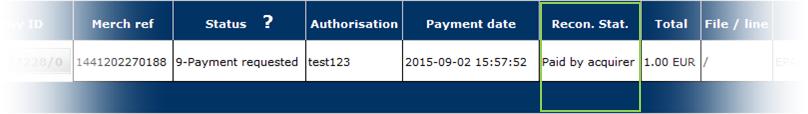

2. Reconciliation status

The Recon. Stat. (Reconciliation status) field, visible in the transaction details screen via View transactions, gives information about the financial processing of the transaction.

These are the possible statuses:

| Viveum Collect | Other (Non-Viveum Collect) | |

|---|---|---|

| Payments | Transaction processed Sent for clearing Received by Ingenico Paid by Ingenico |

Transaction processed Sent to acquirer Paid by acquirer |

| Refunds | Refund pending Refund processed Refund refused |

Refund pending Refund processed Refund refused |

| Bank transfers | Waiting for payment Received by Ingenico Paid by Ingenico Expiration initialized Expired |

FAQs

In your Viveum account menu, you can easily lookup your transactions by choosing "Operations" and then clicking either "View transactions" or "Financial history", depending on the type of transaction results you're looking for.

Go to Consult your transactions for more information.

You can easily refund a payment with the "Refund" button in the order overview of a transaction (via View transactions). If your account supports it, you can also make refunds with a DirectLink request or with a Batch file upload (for multiple transactions).

Please note that the Refunds option has to be enabled in your account.

Go to Maintain your transactions for more information.

You can only perform refunds on transactions for which the funds have already been transferred to your bank account. A cancellation or deletion can be done before a payment has been fully processed, i.e. before the daily cut-off time at the acquirer, at which point all transactions of the previous day are processed.