Transaktionsfehlercodes

1. Introduction

Transaktionsfehlercodes (auch: NCERROR und NCSTATUS) sind Ablehnungsgründe, die unsere Systeme von Acquirern, Emittenten und unseren Betrugstools erhalten. Sie bieten einfache Erklärungen zu Transaktionsfehlern und können im Back Office gefunden werden. In dieser Anleitung gehen wir auf die häufigsten Ablehnungsstatus ein und bieten Ihnen Handlungsempfehlungen. Beachten Sie, dass diese Details weiter unten Informationen sind, die von unserer Plattform anhand des Feedbacks von Acquirern und Emittenten interpretiert werden. Weitere Informationen zu den wichtigsten Transaktionsstatus finden Sie in unserer Anleitung zu Transaktionsstatus.

List of statuses

-

Show Hide

30001101 - Der IP-Adresse zugeordnetes Land entspricht nicht dem Land der Kartenausgabe

Warum habe ich diese Ablehnung erhalten?

Diese Ablehnung erfolgte durch Ihr „Fraud Detection Module“. Demnach haben Sie eine Regel, die Transaktionen mit einem anderen IP-Land als dem Kartenland blockiert.

Was kann ich tun?

Wenn Sie befürchten, dass diese Betrugsregel zu streng ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren: Gehen Sie im Back Office zu Fortgeschritten > Betrugserkennung. Wählen Sie eine Zahlungsmethode aus. Gehen Sie unter IP Daten zu IP-Land entspricht nicht Ausstellungsland der Kart und wählen Sie „Keine“ aus.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30001104 - IP-Adresse eines nicht autorisierten Landes

Waarom kreeg ik deze weigering? Deze transacties zijn geweigerd door jouw Fraud Detection Module (Advanced) omdat de locatie van de klant in jouw blacklist staat.

Wat kan ik eraan doen?

Gebruik onze bedrijfsinformatie-tool MyPerformance om te bepalen welk land het hoogste aantal weigeringen van dit type heeft. Als het onwaarschijnlijk is dat je echte klanten hebt in dat land, moet je het in je blacklist houden. Als je echter denkt dat je blacklist te strikt is en dat je legitieme transacties blokkeert, kun je desgewenst je instellingen herzien. Ga naar Geavanceerd > Fraudedetectie in Back Office en bewerk je IP-Adresse in der Blacklist om dit te doen.

Je kunt een meer granulaire controle uitoefenen over je fraude-instellingen met Fraud Detection Module Advanced. Raadpleeg onze fraudehandleidingen voor het updaten van jouw Fraud Expert Scoring of Fraud Expert Checklist.

-

Show Hide

30001140 - Karten in Kartensperrliste des Händlers

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen wurden vom Fraud Detection Module (Advanced) abgelehnt. Die Kartennummer ist auf Ihrer schwarzen Liste aufgeführt.

Was kann ich tun?

Das sind gute Neuigkeiten, da die Wahrscheinlichkeit hoch ist, dass sehr viele dieser Transaktionen Betrugsversuche sind, die Sie verhindert haben. Wenn Sie befürchten, dass Ihre schwarze Liste zu streng ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie im Back Office zu Fortgeschritten > Betrugserkennung und bearbeiten Sie dazu Ihre Karte in der Blacklist.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30001141 - E-Mail in der Blacklist

Warum habe ich diese Ablehnung erhalten? Diese Transaktionen wurden vom Fraud Detection Module (Advanced) abgelehnt, da die E-Mail-Adresse dieses Kunden auf Ihrer schwarzen Liste aufgeführt ist.

Was kann ich tun?

Das sind gute Neuigkeiten, da die Wahrscheinlichkeit hoch ist, dass sehr viele dieser Transaktionen Betrugsversuche sind, die Sie verhindert haben. Wenn Sie befürchten, dass Ihre schwarze Liste fehlerhaft ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie im Back Office zu Fortgeschritten > Betrugserkennung und bearbeiten Sie dazu Ihre E-Mailadresse in der Blacklist.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30001143 - Name des Karteninhabers in der Blacklist

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen wurden vom Fraud Detection Module (Advanced) abgelehnt, da der Name auf der Karte auf Ihrer schwarzen Liste aufgeführt ist.

Was kann ich tun?

Das sind gute Neuigkeiten, da die Wahrscheinlichkeit hoch ist, dass sehr viele dieser Transaktionen Betrugsversuche sind, die Sie verhindert haben. Wenn Sie befürchten, dass Ihre schwarze Liste fehlerhaft ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie im Back Office zu Fortgeschritten > Betrugserkennung und bearbeiten Sie dazu Ihre Name auf Namens-Blacklist.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30001158 - Limit für die E-Mail-Nutzung erreicht

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen wurden vom Fraud Detection Module (Advanced) abgelehnt. Sie haben eine Regel, die die Anzahl der Transaktionen mit derselben E-Mail-Adresse an einem Tag blockiert.

Was kann ich tun?

Das sind gute Neuigkeiten, da die Wahrscheinlichkeit hoch ist, dass es ein Betrugsangriff ist, wenn jemand eine E-Mail-Adresse mehrmals verwendet. Wenn Sie befürchten, dass diese Regel zu streng ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie zu Fortgeschritten > Betrugserkennung und klicken Sie auf die Einstellungen zu jeder Zahlungsmethode. Gehen Sie unter Kontaktdaten zu max. Nutzung Email-Adresse und klicken Sie auf Nutzungslimits bearbeite.

Mit dem Fraud Detection Model Advanced können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30001180 - Maximaler Scoring-Wert erreicht

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen wurden vom Fraud Detection Module (Advanced) abgelehnt. Das Gesamtrisiko lag über der Akzeptanzschwelle.

Was kann ich tun?

Das sind gute Neuigkeiten, da die Wahrscheinlichkeit hoch ist, dass sehr viele dieser Transaktionen Betrugsversuche sind, die Sie verhindert haben. Wenn Sie jedoch befürchten, dass Ihr Fraud Scoring zu streng ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie zu Fortgeschritten > Betrugserkennung. Wählen Sie eine Zahlungsmethode aus und konfigurieren Sie die FDMA-Einstellungen.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist -Einstellungen zu aktualisieren.

-

Show Hide

30031001 - Ungültige Händlernummer

Warum habe ich diese Ablehnung erhalten?

Mit dem Acquirer, der die von Ihnen angegebene Händler-ID akzeptiert, liegt ein Problem vor.

Was kann ich tun?

Fragen Sie Ihren Acquirer, warum MerchantID nicht akzeptiert wird.

-

Show Hide

30041001 - Karte einbehalten

Warum habe ich diese Ablehnung erhalten?

Diese Antwort kommt vom Emittenten, sobald eine Karte abgelaufen ist. Es kann auch sein, dass die Karte für einen Betrug verwendet wurde.

Was kann ich tun?

Achten Sie darauf, dass Ihre Kunden gültige Karten benutzen. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben.

Wenn Sie das noch nicht getan haben, setzen Sie diese Transaktionen jetzt auf Ihre schwarze Liste. Wenn derselbe Betrüger es noch einmal mit einer anderen Karte versucht, wird er aufgrund der anderen mit dieser Transaktion verbundenen Informationen blockiert. Gehen Sie im Back Office zu Vorgänge > Transaktionsansicht. Öffnen Sie die Transaktion und klicken Sie auf Bezahlungs ID. Klicken Sie auf Streitfall und wählen Sie unter „Zur schwarzen Liste hinzufügen“ die Transaktionsdaten aus. Klicken Sie auf Speichern.

Mit dem Fraud Detection Model Advanced können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30051001 - Genehmigung verweigert

Warum habe ich diese Ablehnung erhalten? Der Emittent hat die Transaktion abgelehnt. Dies sind die einzigen Informationen, die sie dem Acquirer zur Verfügung gestellt haben. Emittenten beschränken Informationen häufig, um Kunden Datenschutz zu bieten oder Informationen vor Betrügern zurückzuhalten.

Was kann ich tun?

Dies ist der häufigste Ablehnungsgrund von Acquirern. Wenn Sie jedoch einen starken Anstieg dieser Art von Ablehnung verzeichnen, können Sie versuchen, sich mit Ihren Acquirern für weitere Informationen in Verbindung zu setzen.

Damit Sie feststellen können, wie viele dieser Transaktionen wahrscheinlich Betrugsversuche waren, rufen Sie im Back Office unter Operations > View Transactions die Betrugsbewertung auf. Mit dem Fraud Detection Model Advanced können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30051017 - Besuchen Sie für weitere Informationen bitte website of AfterPay.

Warum habe ich diese Ablehnung erhalten? Ihr Fraud Detection Module (Advanced) hat diese Transaktionen abgelehnt, da die bank identification number (BIN) auf Ihrer blacklist ist. Es sind die ersten 4 bis 6 Ziffern der Kartennummer, die den Emittenten identifizieren.

Was kann ich tun?

Wenn Sie befürchten, dass Ihre blacklist zu streng ist und Sie legitime Transaktionen blockieren, sollten Sie Ihre Einstellungen kontrollieren. Gehen Sie im Back Office zu Fortgeschritten > Betrugserkennung und bearbeiten Sie dazu Ihre BIN blacklist . Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihre Fraud Expert Scoring - oder Fraud Expert Checklist -Einstellungen zu aktualisieren.

-

Show Hide

30141001 - ungültige Kartennummer

Warum habe ich diese Ablehnung erhalten? Der Emittent hat einen Fehler mit der Kartennummer gemeldet. Entweder erfolgte die Transaktion über die alte Karte des Kunden oder sie wurde schlicht falsch eingegeben.

Was kann ich tun?

Diese Ablehnung weist häufig darauf hin, dass wiederkehrende Transaktionen Daten verwenden, die nicht aktuell sind. Erinnern Sie Ihre Abonnementkunden daran, ihre Zahlungsdetails zu aktualisieren.

Es kann allerdings auch ein Problem mit der Datenvalidierung Ihrer Integration geben. Achten Sie darauf, dass Sie überprüfen, ob Ihre Kunden die richtige Kartennummer eingeben. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben. Es ist besonders wichtig, Kartennummern zu überprüfen, da ein Kunde, der mehrere Versuche mit einer ungültigen Nummer unternimmt, als Betrugsversuch gezählt werden kann.

Wenn Sie Kunden eine zweite Chance zum erfolgreichen Abschluss des Bestellvorgangs geben möchten, können Sie eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden, um sie daran zu erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht.

-

Show Hide

30171001 - Abbruch durch Kunde

Warum habe ich diese Ablehnung erhalten? Diese Meldung wurde von der Zahlungsmethode iDEAL ausgegeben. Dies bedeutet, dass der Kunde die iDEAL-Zahlungsseite aufgerufen und dann auf die Schaltfläche „Abbrechen“ geklickt hat.

Was kann ich tun?

Wir können nie in allen Fällen wissen, warum Kunden ihre Einkäufe abbrechen. Sie könnten von etwas anderem abgelenkt worden sein oder ihre Meinung geändert haben. Sie könnten den Kunden eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden und sie so daran erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht. Sie könnten ihnen eine E-Mail mit einer Umfrage senden, um weitere Informationen über ihre Erfahrungen zu erhalten.

Wenn Sie genau diese Ablehnung weiter untersuchen möchten, sollten Sie unser Business-Intelligence-Tool MyPerformance benutzen. MyPerformance ist kostenlos. Wenden Sie sich für eine Aktivierung an unser Support-Team. In MyPerformance können Sie mit den Messdaten-Steuerelementen Ihre Ablehnungsrate mit Ihrem Gesamtwert der Ablehnungen vergleichen und nach Zeitraum filtern. Der Abbruch durch den Kunden führt auch zu einer hohen Anzahl abgelehnter Transaktionen, insbesondere in Spitzenzeiten. Möglicherweise hat das jedoch keinen großen Einfluss auf Ihren Gesamtumsatz.

-

Show Hide

30331001 - Karte abgelaufen

Warum habe ich diese Ablehnung erhalten?

Diese Art der Ablehnung tritt im Allgemeinen weniger häufig auf.

Was kann ich tun?

Damit Sie feststellen können, ob diese Transaktionen wahrscheinlich Betrugsversuche waren, rufen Sie im Back Office unter Vorgänge > Transaktionsansicht den „Fraud Expert score“ auf und wählen Sie die Transaktion aus.

Mit dem „Fraud Detection Model Advanced“ können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30431001 - gestohlene Karte, bitte einbehalten

Warum habe ich diese Ablehnung erhalten?

Der Kunde hat eine gestohlene Karte benutzt.

Was kann ich tun?

Sie müssen nichts melden, da die Bank sie bereits als gestohlen gekennzeichnet hat. Wenn Sie das jedoch noch nicht getan haben, setzen Sie diese Transaktionen jetzt auf Ihre schwarze Liste. Wenn derselbe Betrüger es noch einmal mit einer anderen Karte versucht, wird er aufgrund der anderen mit dieser Transaktion verbundenen Informationen blockiert. Gehen Sie im Back Office zu Vorgänge > Transaktionsansicht. Öffnen Sie die Transaktion und klicken Sie auf Bezahlungs ID. Klicken Sie auf Streitfall und wählen Sie unter Der Schwarzen Liste hinzufügen die Transaktionsdaten aus. Klicken Sie auf Speichern.

-

Show Hide

30511001 - unzureichende Geldmittel

Warum habe ich diese Ablehnung erhalten?

Unzureichendes Guthaben heißt, dass Ihr Kunde für diese bestimmte Zahlungsmethode nicht genügend Guthaben auf seinem Konto hatte.

Was kann ich tun?

Überlegen Sie, wie leicht es für Ihre Kunden ist, mit einer anderen Zahlungsmethode zu bezahlen, wenn sie feststellen, dass sie nicht über genügend Guthaben verfügen. Wenn es für den Kunden verständlich und einfach ist, zur Zahlungsseite zurückkehren und die Zahlungsmethoden ändern, kann sich Ihre Gesamtablehnungsrate verringern. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben.

Der Kunde hat möglicherweise ein Limit für seine Karte. Überlegen Sie, wie leicht es ist, den Inhalt ihres Einkaufswagens zu ändern, um die Gesamtsumme zu verringern. Sie könnten den Kunden eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden und sie so daran erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht.

-

Show Hide

30581001 - Transaktion mit diesem Terminal nicht erlaubt

Warum habe ich diese Ablehnung erhalten?

Die Kundenkarte funktioniert bei dieser Art von Transaktion nicht. Dies ist ein häufiger Fehler von Kunden, die Firmenkarten verwenden.

Was kann ich tun?

Überlegen Sie, wie leicht es für Ihre Kunden ist, mit einer anderen Zahlungsmethode zu bezahlen, wenn sie feststellen, dass sie mit dieser Karte nicht bezahlen können. Wenn es für den Kunden verständlich und einfach ist, zur Zahlungsseite zurückkehren und die Zahlungsmethoden ändern, kann sich Ihre Gesamtablehnungsrate verringern.

Sie könnten den Kunden eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden und sie so daran erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht.

-

Show Hide

30591001 - Verdacht auf Betrug

Warum habe ich diese Ablehnung erhalten?

Die Transaktion wurde vom Emittent abgelehnt, da die Karte möglicherweise bei einem Betrug benutzt wurde.

Was kann ich tun?

Wenn Sie das noch nicht getan haben, setzen Sie diese Transaktionen jetzt auf Ihre schwarze Liste. Wenn derselbe Betrüger es also noch einmal mit einer anderen Karte versucht, wird er aufgrund der anderen mit dieser Transaktion verbundenen Informationen blockiert. Gehen Sie im Back Office zu Vorgänge > Transaktionsansicht. Öffnen Sie die Transaktion und klicken Sie auf Bezahlungs ID. Klicken Sie auf Streitfall und wählen Sie unter Zur schwarzen Liste hinzufügen die Transaktionsdaten aus. Klicken Sie auf Speichern.

Mit dem Fraud Detection Model Advanced können Sie Ihre Betrugseinstellungen genauer steuern. Lesen Sie unsere Leitfäden zu Betrug, um Ihr Fraud Expert Scoring oder Ihre Fraud Expert Checklist zu aktualisieren.

-

Show Hide

30621001 - eingeschränkte Karte

Warum habe ich diese Ablehnung erhalten?

Die für diese Transaktionen verwendeten Karten durften diese Art von Zahlungen nicht ausführen. Sie können z. B. eine Sicherheitseinstellung haben, die Online-Einkäufe verhindert.

Was kann ich tun?

Diese Ablehnung erfolgt auf Kundenseite, deshalb können Sie nicht viel tun. Der Karteninhaber muss sich mit seiner Bank in Verbindung setzen, herausfinden, was die Transaktion verhindert, und die Beschränkungen aufheben. Überdenken Sie Ihre derzeit angebotenen Zahlungsmethoden. Haben Ihre Kunden eine Alternative, wenn sie ein Problem mit einer ihrer Karten haben?

Überlegen Sie, wie leicht es für Ihre Kunden ist, mit einer anderen Zahlungsmethode zu bezahlen, wenn sie feststellen, dass ihre Karte nicht funktioniert. Wenn es für den Kunden verständlich und einfach ist, zur Zahlungsseite zurückkehren und die Zahlungsmethoden ändern, kann sich Ihre Gesamtablehnungsrate verringern. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben.

-

Show Hide

30921001 - falscher Kartentyp

Warum habe ich diese Ablehnung erhalten?

Das heißt, dass einer Ihrer Acquirer diesen bestimmten Kartentyp nicht akzeptiert.

Was kann ich tun?

Wenn dies eine häufige Ablehnung für Ihr Unternehmen ist, sollten Sie sich eventuell mit Ihrem Acquirer in Verbindung zu setzen, um Ihren Vertrag zu besprechen. Für Ihr Konto können Akzeptanzbeschränkungen gelten.

-

Show Hide

40001134 - Authenticatie mislukt, probeer opnieuw of annuleer.

Warum habe ich diese Ablehnung erhalten?

Für diese Transaktionen wurde eine 3-D Secure(3DS)-Authentifizierung angefordert. Diese ist jedoch fehlgeschlagen. Das ist in vielen Fällen jedoch eine positive Ablehnung, da dadurch Betrugsversuche verhindert werden. Es besteht natürlich auch die Möglichkeit, dass darunter einige seriöse Kunden waren, die sich nicht authentifizieren konnten.

Was kann ich tun?

Bei seriösen Kunden, die die 3DS-Authentifizierung nicht erfolgreich abschließen können, gibt es viele Faktoren, die Sie nicht beeinflussen können. Ihr Kunde hat möglicherweise ein technisches Problem mit seinem Gerät oder Netzwerk, ein verlegtes Kartenlesegerät oder einen vergessenen PIN-Code. Es gibt jedoch einige Best Practices, die Sie umsetzen können, um das allgemeine Bestellvorgangserlebnis für Kunden in Bezug auf 3DS zu verbessern.

Die neueste Version von 3DS ist für Kunden benutzerfreundlicher und es können mehr Transaktionen die Authentifizierung umgehen. Prüfen Sie, ob Ihre Integration auf dem neuesten Stand ist, damit Sie die entsprechenden Parameter senden können.

3DS-Logos werden den Kunden immer vertrauter und können sie bei der Vorbereitung auf die Authentifizierung unterstützen, z. B. beim Bereithalten ihres Kartenlesegeräts. Achten Sie darauf, dass Sie die neuesten Logos auf Ihrer Zahlungsseite haben.

-

Show Hide

40001135 - Authentication temporarily unavailable. Please retry or cancel.

How did I get this rejection? These transactions had to go through 3-D Secure (3DS) authentication. However, at the time of processing the card issuer was not available to confirm the identity of the cardholder.

What can I do about it?

This error comes from the issuing bank and is out of your control. However, you could consider making the checkout easier for customers experiencing problems with their bank. Consider the payment methods you currently offer. Do your customers have an alternative if they are having an issue with one of their cards?

Making it clear and easy to return to the payment page and change payment methods could reduce your overall rejection rate. If your payment page is hosted on our platform, make sure you have implemented the latest optimised version.You could also consider sending a follow up email to the customer with their selected purchases, reminding them to complete their purchase at a later time. You can find the customer details by going to Operations > View Transactions in the Back Office.

-

Show Hide

40001137 - Der Zugangskontrollserver Ihrer Bank ist vorübergehend nicht verfügbar, bitte nochmals versuchen oder abbrechen

Warum habe ich diese Ablehnung erhalten? 3-D Secure konnte aufgrund technischer Probleme nicht ausgeführt werden. Sie haben bei unserer Plattform angefragt, die Autorisierung dennoch durchzuführen.

Was kann ich tun?

Da 3-D Secure aufgrund der PSD2-Richtlinie Pflicht ist, wurde die Transaktion vom Kreditkartenherausgeber des Kunden abgelehnt.

-

Show Hide

40001138 - Authentication temporary unavailable. Please try again later or choose another payment method.

How did I get this rejection? These transactions had to go through 3-D Secure (3DS) authentication. However, at the time of processing we were unable to confirm the identity of the cardholder due to an unexpected failure.

What can I do about it?

To recover this declined transaction, resubmit the transaction at a later time or suggest another payment method to the cardholder.

You can find the customer details by going to Operations > View Transactions in the Back Office.

-

Show Hide

40001139 - Authentifizierung erforderlich. Das Bank besteht auf 3-D Secure.

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen werden auch als Soft-Decline-Transaktionen bezeichnet. Diese treten auf, wenn Sie versuchen, die starke Kundenauthentifizierung zu überspringen. Die Bank des Kunden hat jedoch auf 3-D Secure bestanden. Da dies nicht der Fall war, wurde die Transaktion abgelehnt. Diese Transaktionen treten nur bei einer DirectLink-Integration auf.

Was kann ich tun?

Wenn Sie diese abgelehnte Transaktion wiederherstellen möchten, senden Sie die Transaktion noch einmal. Senden Sie dazu diese Parameter an unsere Plattform:

- Senden Sie die DirectLink-Parameter für Standardanfragen so, wie sie in Ihrer ersten Anforderung gesendet wurden, als neuen Auftrag.

- FLAG3D=Y, um anzuzeigen, dass 3-D Secure eingeführt werden muss

- Die 3DSv2-Authentifizierungsparameter.

- Senden Sie Mpi.threeDSRequestorChallengeIndicator=04, um darauf hinzuweisen, dass die Bank Ihres Kunden nach dem Soft Decline auf 3-D Secure besteht

Ihr Kunde muss bei dieser zweiten Anfrage die 3-D Secure-Authentifizierung durchlaufen. Je nachdem, ob die Authentifizierung erfolgreich war, ändert sich der Transaktionsstatus entweder in Status 2 oder 9.

-

Show Hide

50001054 - Kartennummer ungültig oder inkompatibel

Warum habe ich diese Ablehnung erhalten?

Normalerweise kommt es zu dieser Ablehnung, wenn die erwartete und die eingegebene Kartenmarke nicht übereinstimmten. Wenn Sie Transaktionen von anderen Händlern oder Geschäftspartnern erhalten, kann es auch sein, dass diese eine ungültige Nummer verarbeitet haben.

Was kann ich tun?

Überprüfen Sie Ihre Integration noch einmal, damit Sie ungültige Kartendaten tatsächlich erkennen. Machen Sie dasselbe für sämtliche Ihrer Geschäftspartner. Ziehen Sie in Erwägung, Ihrer Zahlungsseite die automatische Erkennung des Kartentyps hinzuzufügen. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben.

Wenn Sie Kunden eine zweite Chance zum erfolgreichen Abschluss des Bestellvorgangs geben möchten, können Sie eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden, um sie daran zu erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht .

-

Show Hide

50001087 - Dieser Transaktionstyp benötigt Authentifizierung, bitte kontaktieren Sie Ihre Bank

Warum habe ich diese Ablehnung erhalten? Dies weist darauf hin, dass für die für diese Transaktionen verwendete Zahlungsmethode 3D-Secure (3DS) erforderlich ist, bei der 3DS-Integration jedoch ein Problem aufgetreten ist.

Was kann ich tun?

Prüfen Sie, ob Ihre Zahlungsmethoden in die 3DS-Authentifizierung integriert und auf dem neuesten Stand sind.

Möglicherweise ist auch ein Problem mit der Karte oder dem Emittenten des Kunden aufgetreten. Damit Sie das überprüfen können, gehen Sie im Back Office zu Vorgänge > Transaktionsansicht . Öffnen Sie die Transaktion und überprüfen Sie die Authentifizierungsprotokolle. Wenn Sie in der Spalte Details enrollmentStatus: Failed sehen, ist die Authentifizierung fehlgeschlagen. Bitten Sie den Kunden, es mit einer anderen Zahlungsmethode noch einmal zu versuchen.

Sie sollten auch unser Business-Intelligence-Tool MyPerformance vertraut zu machen. MyPerformance ist kostenlos. Wenden Sie sich für eine Aktivierung an unser Support-Team.

-

Show Hide

50001081 - Empfangenes PARes Format war nach 3-D Secure Spezifikationen (3-D Secure) ungültig

Warum habe ich diese Ablehnung erhalten?

Diese Transaktionen mussten die 3-D Secure(3DS)-Authentifizierung durchlaufen. Während der Verarbeitung ist jedoch ein technischer Fehler aufgetreten.

Was kann ich tun?

Dies ist ein technischer Fehler des Emittenten und liegt außerhalb Ihrer Kontrolle. Sie könnten jedoch eventuell den Bestellvorgang für die Kunden, die Probleme mit ihrer Bank haben, vereinfachen. Überdenken Sie Ihre derzeit angebotenen Zahlungsmethoden. Haben Ihre Kunden eine Alternative, wenn sie ein Problem mit einer ihrer Karten haben?

Wenn es für den Kunden verständlich und einfach ist, zur Zahlungsseite zurückkehren und die Zahlungsmethoden ändern, kann sich Ihre Gesamtablehnungsrate verringern. Wenn Ihre Zahlungsseite auf unserer Plattform gehostet wird, achten Sie darauf, dass Sie die neueste optimierte Version implementiert haben.

Sie könnten den Kunden eine Nachfolge-E-Mail mit den ausgewählten Einkäufen senden und sie so daran erinnern, den Einkauf zu einem späteren Zeitpunkt abzuschließen. Die Details zum Kunden finden Sie im Back Office unter Vorgänge > Transaktionsansicht.

-

Show Hide

50001111

Why do I get this?

- This is a generic error message for data validation errors. It will appear in one of the following scenarios

- You send wrong data in parameters USERID / PSWD

- Your transaction request is missing one or more mandatory parameters

- Parameters sent to our platform contain no values or invalid values

For which integration modes can this happen?

What can I do to solve this?

- Configure your API user and API password in both your system and in the Back Office

- Make sure to send all mandatory parameters correctly as described in our documentation for the respective integration mode.

2. Wie kann ich die Fehlercodes abrufen?

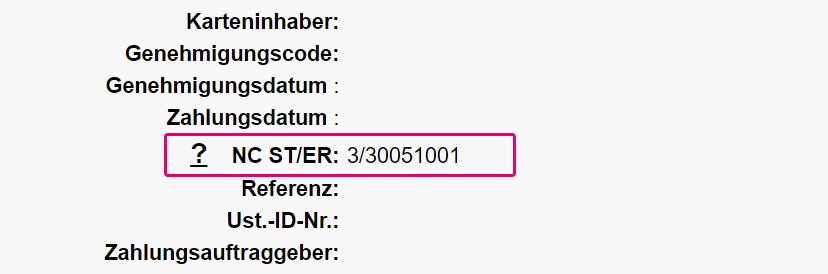

Sie können diese Fehlercodes im Back Office unter Vorgänge > Transaktionsansicht abrufen. Suchen Sie die Bezahlungs ID der betroffenen Transaktion. In den Details Ihrer Transaktion sehen Sie NC ST/ER (bezieht sich auf NCSTATUS und NCERROR). Klicken Sie für eine Übersicht aller möglichen Status- und Fehlercodes auf ?.

Für alle Transaktionen (außer eTerminal) können Sie in Ihrem Server-zu-Server-Feedback auch auf diese Informationen zugreifen.

3. Richtlinien für wiederholte Zahlungen

Wir helfen Ihnen gerne dabei, Zahlungswiederholungen zu verwalten und dabei konform mit den Kartennormen zu bleiben. Wenn eine Transaktion fehlschlägt, können Sie die Zahlungsanforderung über eine Händler-gesteuerte Transaktion (MIT) innerhalb des Card On File Framework (COF) erneut einreichen.

Da dies bedeutet, dieselbe PAN (d. h. Kartennummern) und denselben Betrag pro einzelner Bestellung erneut zu verwenden, begrenzen Mastercard und Visa Wiederholungsversuche, um übermäßige Versuche zu verhindern. Gebühren können bei Acquirern anfallen, wenn Schwellenwerte überschritten werden; Wiederholungsversuche können jedoch weiterhin erfolgreich sein.

Unsere Plattform gibt Ihnen die volle Kontrolle über Entscheidungen zu Wiederholungsversuchen. Wir empfehlen dringend, eine Richtlinie zu implementieren, die zu Ihrem Geschäftsmodell passt und dabei den Regeln der Kartennetzwerke entspricht. Verwenden Sie die Fehlercode-Kategorien im folgenden Kapitel als Orientierung.

Fehlercode-Kategorien

Unsere Plattform unterscheidet zwischen zwei Arten von Fehlercodes:

1) Nicht wiederholbare Fehler

Diese kennzeichnen permanente Probleme mit der Transaktion. Wir empfehlen dringend, die Zahlungsanforderung nicht erneut zu übermitteln. Diese enthalten die folgenden Fehler:

| Fehlercode | Beschreibung |

|---|---|

| 30041001 | Karte einziehen (kein Betrug) |

| 30071001 | Karte einziehen, besondere Bedingung (Betrugsfall) |

| 30121001 | Ungültige Transaktion |

| 30141001 | Ungültige Kartennummer |

| 30151001 | Keine solche Ausstellerbank (die ersten 8 Ziffern der Kontonummer beziehen sich nicht auf einen Ausstellerkennzeichner) |

| 30411001 | Verlorene Karte, Abholung |

| 30431001 | Gestohlene Karte, Abholung |

| 30571001 | Transaktion auf Karte nicht erlaubt |

| 33000972 | Stop-Zahlungsauftrag |

| 33000973 | Widerruf des Autorisierungsauftrags |

| 33000975 | Widerruf aller Autorisierungen |

| 33000833 | Für erneute Übermittlung nicht berechtigt |

2) Wiederholbare Fehler

Für alle oben nicht aufgeführten Fehlercodes kann eine erneute Übermittlung nach einem weiteren Versuch erfolgreich sein.

Sie können erneut versuchen, aber begrenzen Sie auf maximal 10 Versuche innerhalb von 30 Tagen, um die Richtlinien der Kartennetzwerke einzuhalten und mögliche Gebühren zu vermeiden.